"It’s not that taxes are far too high for giant corporations, as the lobbyists claim. No, the problem is that the revenue generated from corporate taxes is far too low."

- Senator Elizabeth Warren

Senator Elizabeth Warren gave a "Change Is In The Air" speech Wednesday, talking about corporate tax reform. If there was ever an Elizabeth Warren speech to see, it is this one.

Warren began by describing how lobbyists and corporate CEOs are swarming Congress and saturating the media with a pitch that says corporations are paying too much in taxes, that this is forcing corporations to flee abroad and the solution is to slash corporate tax rates. This story of overtaxation is told and retold.

Warren says there is just one problem with this: "It’s not true."

Actually, on average corporations only pay 20 percent of their income in taxes. Some pay zero. Boeing, GE, and Verizon paid nothing in 5 years while reporting $80 billion in combined profits.

"So what’s the problem with our corporate tax code? It’s not that taxes are far too high for giant corporations, as the lobbyists claim. No, the problem is that the revenue generated from corporate taxes is far too low.

This trend line is unmistakable. Over the past 60 years corporations contributed a smaller and smaller share of costs of running government. Back in the 1950s, corporations contributed about $3 out of every $10 in federal revenue. Today corporations contribute just $1 out of every $10."

The Amount Is Staggering

Warren said the amount of money the giant corporations have stashed outside the country in tax havens – and the tax bill they would owe – is staggering. They have $2.1 trillion in untaxed profits sitting offshore. This is the same as the combined total earnings of all U.S. corporations in 2013. (This amount of profits in tax havens means these companies owe our government around $620 billion, and this amount is growing by about $90 billion each year now.)

The tax bonus is not shared evenly; it is rigged for the really big guys. "Out of the millions of businesses in the U.S., just 50 corporations hold 75 percent of the $2.1 trillion in untaxed offshore profits. And even in that rarefied air, there’s a Tax Dodger Hall of Fame. Just 10 American companies hold more than a third of all those offshore profits," Warren said.

This rigs the game against families and smaller businesses that have to pick up the slack. Families and small U.S. companies pay 17.5 percent. The biggest corporations pay less, even zero.

"They get all the benefits but leave it to families and small businesses to pick up the tax bill," Warren said.

How To Fix Taxes

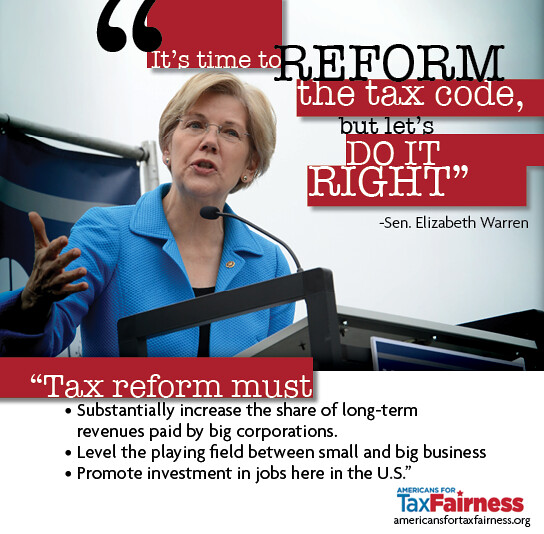

Warren laid out three principles for tax reform that benefits middle-class families and small businesses, not just wealthy multinational corporation:

1) Increase the share of revenue that corporations pay. The tax code now is so tilted toward the big corporations that any "revenue neutral" plan leaves the country with too little money to fund basic services.

2) Level the playing field between small and big businesses. The business tax code is rigged against small businesses, making it harder for them to compete.

3) Promote investment and jobs in the U.S. Lower tax rates and loopholes for hiding profits overseas encourages more outsourcing of jobs and investment. "Our tax code should protect jobs and investment here at home, period," Warren said.

Instead Congress Is Considering Giving Tax-Dodging Corporations "A Big Wet Kiss"

But instead of changing the tax code to benefit families and smaller businesses, Congress is acting under the influence of CEOs and corporate lobbyists.

"Congress talks to CEOs and their armies of lawyers and lobbyists who are pushing some genuinely terrible ideas," Warren explained. She went on to detail three tax proposals that are getting the most attention:

First, “deemed repatriation.” Warren called this "a giant wet kiss for the tax dodgers who have already parked $2.1 trillion overseas. Deemed repatriation says bring home the money, but pay only half of what you owe on it. Or, if the kiss isn’t wet enough, some are suggesting the repayment rate should be even less than half, maybe around 14 percent.

"Think about what this means. All the small business owners who have been paying their taxes in full can keep right on paying in full. But the tax dodgers will get a special deal.

"And what’s the total price tag for this juicy smooch? Estimates are in the range of $300 to $400 billion paid by U.S. taxpayers."

The second idea in front of Congress is to have a lower offshore tax rate. Maybe 35 percent here, 19 percent there.

"It’s like holding up a giant sign that says 'Higher taxes if you invest in the U.S., lower taxes if you invest abroad.' The result would be that every small business and family in America would be subsidizing foreign investments of multinational corporations — which is a great deal for those multinationals and our foreign competitors, but a terrible deal for us."

The third idea is something corporate tax lobbyists are calling an "innovation box." Companies that say they are "innovating" can pay a lower tax rate. "For big pharmaceutical companies and giant tech companies, a provision like this just makes paying taxes — or a chunk of taxes — optional. I strongly support a robust innovation policy – like investing in the NSF (National Science Foundation) and the NIH (National Institutes of Health), funding basic research, and encouraging companies to invest in research — but the innovation box doesn’t do a single thing to encourage new innovation."

The Same Rigged Game

Warren warned that lobbyists are excited about the coming tax reform. "But when I look at the details, I see the same rigged game – a game where Congress hands out billions in benefits to big, well-connected corporations, while people who really could use a break – the millions of middle-class families and small businesses that have been squeezed for decades – are left holding the bag."

And this is where Warren makes the big point:

"And that’s what this tax battle is really about: Who does this country work for? Is it just for the rich and the powerful, those who can hire those armies of lobbyists and lawyers? Or can we make this country work for millions of hard-working people?

"This isn’t a fair fight. The corporate giants are lined up to make sure tax changes tilt their way. America’s working families don’t have a zillion-dollar PR team to counter the false claim that corporate taxes are too high. Small businesses don’t have a zillion-dollar lobbying organization to fight back against tax giveaways for giant corporations."

Warren ends by saying she hopes people will pay close attention.

Also, in the Q&A Warren gives the best outline of what has led to the rigged game and the terrible inequality we have today. It is a must-watch.

Americans for Tax Fairness has produced a booklet of 16 charts and data tables that use publicly available data to disprove some of the claims made in support of the arguments for these huge corporate tax breaks.

See also:

● Report: “Single Sales Factor Apportionment of Global Profits to Broaden the Tax Base”

● A Simplified Way To Tax Multinational Corporations

● A Corporate Tax Idea That Fixes Lots Of Problems

● Corporations Demand Budget Cuts, Owe Government $620 Billion

● Should We Give The Worst Tax-Dodging Corporations A Huge Break?

● Next Big One: Repatriation Tax Giveaway To Corporations

● Trump: Don't Make Corporations Pay Their Taxes

● Coming Up: Repatriation, A HUGE Huge Tax Giveaway To Big Corporation

● A Better Way To Tax The Multinationals

-------

This post originally appeared at Campaign for America's Future (CAF) at their Blog for OurFuture. I am a Fellow with CAF. Sign up here for the CAF daily summary and/or for the Progress Breakfast.