Back in August, Americans learned that among Rick Perry's miserable grades in college was a "D" in "Principles of Economics." Now we know why. His contribution to the GOP's flat tax one-upsmanship not only fails to simply the U.S. tax code. As it turns out, Governor Perry's "Cut, Balance and Grow" scheme would undermine Social Security, produce mountains of debt and require draconian spending cuts, all while ensuring a massive windfall for the wealthy.

On that last point, the Texas Governor is honest and untroubled. At a time of record income inequality, Perry told CNBC's John Harwood he was unconcerned that the richest Americans would receive "hundreds of thousands, maybe even millions of dollars" as a result of his tax plan:

"But I don't care about that. What I care about is them having the dollars to invest in their companies."

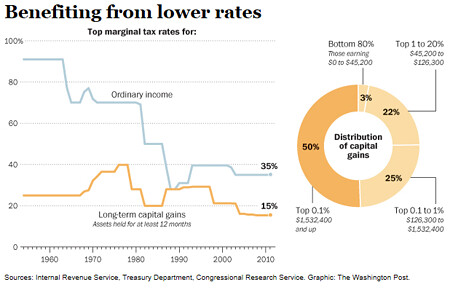

And to be sure, Rick Perry wants to ensure that the wealthy have more dollars - a lot more. His optional 20% flat tax rate would allow the top income earners to pay Uncle Sam at a much lower rate than the already low 35% level they pay currently. And Perry would not merely eliminate the estate tax, he would zero out the capital gains tax as well. As the Washington Post recently explained, "For the very richest Americans, low tax rates on capital gains are better than any Christmas gift":

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

While Perry's plan delivers a gargantuan payday for the gilded class, it fails in its supposed objective to simplify the tax code. After all, by "giving Americans a choice between a new, flat tax rate of 20% or their current income tax rate," taxpayers need to figure out their own return twice in order to decide which options benefits them most. And the lower payments they would choose to make, combined with the loss of revenue from the estate tax, the capital gains tax and a corporate tax slashed from 35 percent to 20 percent, means that Rick Perry's would literally drain trillions from the U.S. Treasury in the decades to come.

But like his windfall for the wealthy, that's OK with Rick Perry, too.

That because, as he writes in the Wall Street Journal, "Under my plan, we will establish a clear goal of balancing the budget." To get there, Perry would put down his guns and pick up the budget ax:

We should start moving toward fiscal responsibility by capping federal spending at 18% of our gross domestic product, banning earmarks and future bailouts, and passing a Balanced Budget Amendment to the Constitution.

Of course, there are a few problems with Rick Perry's wishful thinking. As these historical tables from the Office of Management and Budget show, the last time federal spending was less than 18 percent of GDP was in 1966. That mythical paragon of Republican fiscal discipline Ronald Reagan never got close to Perry's spending target, though Democrat Bill Clinton did.

Rick Perry's "Cut, Balance and Grow" proposal, just like the Republicans' "Cut, Cap and Balance Act" before it, would make constitutional criminals out of the likes of Ronald Reagan and Paul Ryan.

To meet his own mandates, Rick Perry would have to gut the federal budget. In 2010, the government spent $3.5 trillion while its recession-ravaged revenues were only a paltry $2.2 trillion. But with his scheme for Social Security, Rick Perry would make the red ink - and the draconian spending cuts - much, much worse.

As Perry explained it, younger workers could shift their Social Security contributions to private accounts even as Congress is prohibited from funding the general budget using the trust fund surplus:

To preserve benefits for current and near-term Social Security beneficiaries, my plan permanently stops politicians from raiding the program's trust fund. Congressional IOUs are no substitute for workers' Social Security payments. We should use the federal Highway Trust Fund as a model for protecting the integrity of a pay-as-you-go system.

Cut, Balance and Grow also gives younger workers the option to own their Social Security contributions through personal retirement accounts that Washington politicians can never raid. Because young workers will own their contributions, they will be free to seek a market rate of return if they choose, and to leave their retirement savings to their dependents when they die.

If Perry's fuzzy math sounds familiar, it should. It's not just that having previously called Social Security unconstitutional, Rick Perry is repackaging George W. Bush's failed privatization gambit. As it turns out, Perry like his Texas predecessor would divert trillions of dollars from today's recipients.

As Matthew Yglesias described one aspect of the problem for the would-be Republican reformers like Perry:

What privatizers want to say is that current retirees will keep getting benefits and future retirees will be okay despite our lack of benefits because we'll have private accounts. But current retirees can't get benefits if my money is in a private account. And my account can't be funded if I'm paying benefits for current retirees.

As it turns out, Vice President Al Gore made the same point during his presidential debates against then Governor George W. Bush. "Because the trillion dollars that has been promised to young people has also been promised to older people," Gore explained, adding, "And you cannot keep both promises."

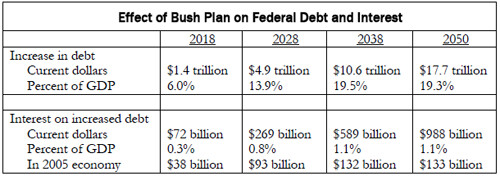

And by diverting money to private accounts from the Social Security trust-fund, Republicans also can't keep their born-again promises to lower the national debt. In 2005, James Horney and Richard Kogan of the Center on Budget and Policy Priorities totaled up the fiscal hemorrhaging that would ensue from the privatization plans of President Bush and other Republicans:

The President's plan would create $17.7 trillion in additional debt by 2050. This additional debt would be equal to 19.3 percent of the Gross Domestic Product in 2050.

At the end of the day, Rick Perry's numbers simply don't add up. But that should come as no surprise. After all, at Texas A&M he averaged a C in algebra and trigonometry, and got that D in economics. Which is why Perry took a break from his pitching his "Cut, Balance and Grow" plan to say to President Obama:

"Say, how about let's see your grades and your birth certificate."

(This piece also appears at Perrspectives.)